Membership

Membership Made Easy

It's now easier than ever to join Altura Credit Union. With advanced biometric facial verification, and the ability to submit proof of ID, we're offering you a safe and reliable way to become a member without the need to visit a branch. Read on for more information. You will need your Photo ID, Recent Proof of Address and we sill seek proof of your PPS number. Note: You must be within our common bond area to become a member

Click on the below option that best suits your needs for more information

These accounts can be opened using our app. No need to visit a branch, if you prefer the quicker option at a time that suits you.

All Adult Members must provide.

1. Photo ID – Driver’s Licence, Passport, National Identity Card etc.

2. Proof of Address – A recent Utility Bill(mobile phone & broadband bills cannot be accepted), Bank Statement, Motor Taxation/ Insurance Renewal, Government Dept. Correspondence etc. These documents must be dated within the last 6 months

3. We are required to seek proof of PPS Number – Older Medical Cards, EHIC Card, Payslip, Social Welfare document (Must be on an official document, unfortunately we can no longer accept the Public Services card as proof of PPS).

Proof of PPSN is a requirement for all members who wish to borrow or avail of an overdraft.

• There is a Membership fee of €1 (Fee is waived for under 16s)

• An initial lodgement of at least €5 is required, to activate account.

A Child’s Parent/Legal Guardian can open an account. The Parent opening the account must also produce Photo ID. The Proof of Address supplied must be in the parent’s name that is opening the account & dated within the last 6 months

Please Note: If the Child is aged 7, or over, they need to be present at the time of account opening.

Account Opening Requirements

-Childs Birth Certificate.

-Parent(s) recent Proof of Address (within a maximum of 6 Months) and their valid Photo ID

(mobile phone & mobile broadband bills cannot be accepted)

We are required to seek proof of Child’s PPS (Older Medical Cards, EHIC Card, Official Document, Social Welfare Correspondence etc.) Unfortunately, current legislation does not allow us to accept a public services card.

You can decline to provide the PPSN at this stage. However, when the child becomes an adult with a borrowing need - we will have to get it at that stage.

Minor Accounts must be opened in a branch.

An initial lodgement of €5 is required to activate membership.

Two adult members can open a joint account. The below requirements apply to each member.

1. Photo ID – Driver’s Licence, Passport, National Identity Card etc.

2. Proof of Address – A recent Utility Bill(mobile phone & broadband bills cannot be accepted), Bank Statement, Motor Taxation/ Insurance Renewal, Government Dept. Correspondence etc. These documents must be dated within the last 6 months

3. We are required to seek proof of PPS Number – Older Medical Cards, EHIC Card, Payslip, Social Welfare document (Must be on an official document, unfortunately we can no longer accept the Public Services card as proof of PPS).

Proof of PPSN is a requirement for all members who wish to borrow or avail of an overdraft.

Joint Accounts must be opened in a branch with both parties present.

• There is a Membership fee of €1 (Fee is waived for under 16s)

• An initial lodgement of at least €5 is required, to activate account.

Please contact your local branch, or call 053 94 88700 for more information.

Please contact your local branch or call 053 94 88700 for more information.

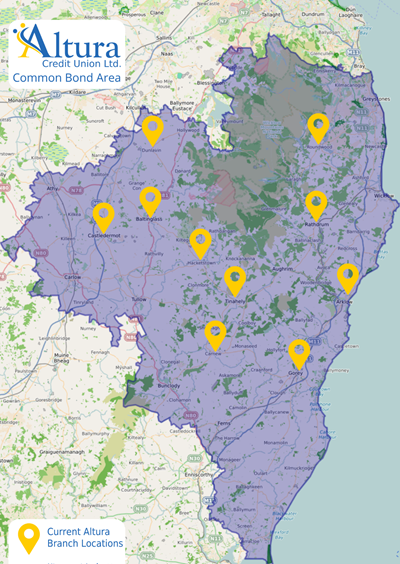

If you, live, work or study in the area on this map - you are eligible to join Altura Credit Union. We have five branches servicing the areas. We have a larger map at the bottom of this page.

Join Using Your Phone

We’ve created an intelligent and secure method for you to become a member directly through your mobile phone. All you have to do is download our Mobile App to take full advantage of joining as you go.

Member Notice:

If you are 16 or older opening a sole account - download our app and join this way to save you time. You can do this from the comfort of your own home - If you have the documents needed to hand.

Currently Joint Accounts, Juvenile Accounts (Under Age 16), Business, Clubs & Society Accounts still need to be opened in one of our five branches.

Helpful advice for Ukrainians who want to join can be found here

Secure Facial Verification

We use advanced biometric facial technology to capture and verify who you are. All it takes is a quick selfie and you’re done. This intuitive technology, ensures becoming a member is quicker than ever.

For All Accounts You Need To Supply Your:

Valid Photo ID

Recent Proof of Address (within 6 Months)

We Will Seek:

Proof of Your PPSN

Reliable Identity Check

We’ve created a way for you to share proof of ID with us that’s both secure and reliable. As you progress with your application, you will be given an opportunity to show your ID there and then. There’s no waiting around.

Quick Online Access

Once your membership has been approved, we'll text you a temporary pin so you can have immediate access to your online account. You won’t have to worry about anything, we will do the rest. Online access is available to adult members only.

In order to start your Online Membership journey, you will need to download our Mobile App. Download today and reap the benefits of becoming a member.

How To get started

Download Our Mobile App

Make sure you have some valid ID on hand!

Complete the form

Verify your Identity

Upload required documentation

Sit back and wait for us to review and approve your membership

This Is The Area We Serve, Across Counties, Carlow, Kildare, Wicklow & Wexford.